The 2026 Annuity Sales Outlook Remains Strong

In a recent LinkedIn Live event, LIMRA projected U.S. retail annuity sales to finish above $460 billion in 2025, marking the fourth consecutive year of record sales. Quarterly results tell the same story: eight straight quarters have exceeded $115 billion, with the third quarter of 2025 surpassing $120 billion.

“There have been a lot of tailwinds for this market — favorable economic factors; remarkable product innovation, drawing in new distribution and investor interest; increased private equity investment, allowing carriers to expand capacity and invest in technology to improve the sales and market process,” said Bryan Hodgens, senior vice president and head of LIMRA Research. “Most importantly, we are in the middle of Peak65, where more than 4 million Americans are turning 65 each year. Our research suggests many of these newly retired or soon-to-be retired individuals are less likely to have access to a pension, leaving them without the guaranteed lifetime retirement income past retirees enjoyed.”

Product Innovation Drives Growth

Beyond the favorable economic conditions and demographics, product innovation has been a major driver of the annuity market growth over the past five years. The rise of registered index-linked annuities (RILAs) has dramatically reshaped the product landscape. RILA sales have surged more than 270% in just a few years, from $24 billion in 2020 to $65 billion in 2024. LIMRA projects RILA sales to exceed $75 billion in 2025 and 2026.

Fixed indexed annuities (FIAs) have nearly doubled during that same window, reaching $126 billion in 2024 with similar results expected for 2025.

At the same time, fee‑based annuities have opened the door to greater adoption among RIAs. These products — now supported by enhanced technology platforms — have doubled in sales since 2020. As more RIAs integrate annuities into holistic planning conversations, this channel is poised for continued expansion.

The 2026 Annuity Sales Forecast

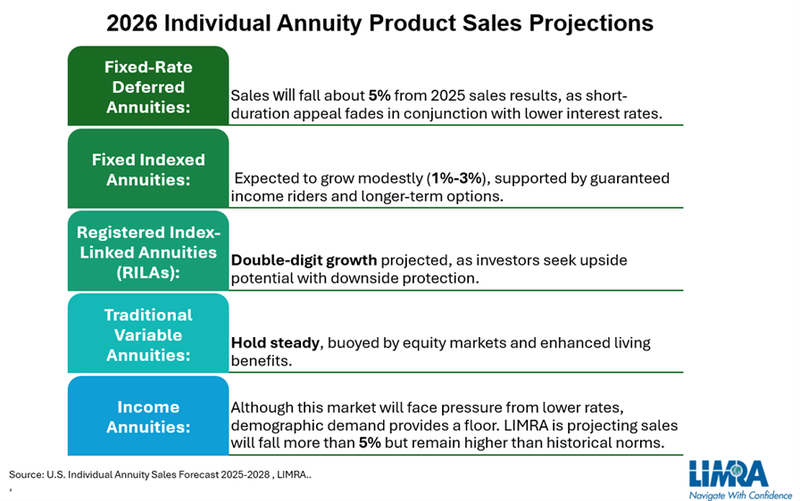

Despite expectations of gradual interest‑rate cuts, LIMRA projects that 2026 annuity sales will remain above $450 billion, supported by strong demographic demand, maturing contracts (“money in motion”), new product development, and technology-driven efficiencies. While cuts in interest rates will dampen the fixed annuity market a bit, interest rates will remain historically high, allowing carriers to offer competitive solutions.

According to LIMRA’s 2026 forecast, indexed-linked product sales will continue to grow as investors seek downside protections coupled with investment growth potential.

“The continued growth of the U.S. annuity market also will depend on robust engagement with financial professionals,” noted Sean Grindall, chief member relations and solutions officer, LIMRA and LOMA. “This year, LIMRA expanded its mission to educate the financial professionals about the value of annuities and the greater options to address the spectrum of their clients’ risk concerns, and about changing landscape that makes annuities a more important component to a holistic retirement plan.”

With millions entering retirement each year and fewer guaranteed lifetime income sources available, the demand for solutions that offer security — and peace of mind — has never been stronger. LIMRA’s forecast reflects not only a moment of growth, but a shift toward a more resilient, consumer-centered retirement landscape.

To watch the full episode of Industry Insights with Bryan Hodgens: What’s Ahead for Retail Life Insurance and Annuity Sales in 2026?

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help nearly 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

We are #TheRightMIXin26 for independent insurance wholesalers and agents. For more than 40 years, AIP Marketing Alliance (AIPMA), an Integrity Company, serves as a premier life insurance and annuity distribution partner to provide full-service support to independent wholesalers, brokerages and agents from our Troy, Michigan office. NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR THE MEDICARE PROGRAM.

AIP Marketing Alliance is committed to supporting our independent insurance wholesalers and agents. Visit our blog on aipma.com to stay informed on these upcoming launches and learn why wholesalers nationwide choose AIPMA as their distributor for selling life insurance, annuities, long-term care insurance, final expense, and much more. Ask about lead programs, access to IntegrityCONNECT’s technology, myAIP CRM platform with customizable recruiter portal, and online tools/resources designed to grow your business. The difference is personal.

AIP Marketing Alliance, an Integrity Company, has developed this electronic communication for informational and educational use only. Be advised, AIP Marketing Alliance, Inc., does not provide legal advice, tax advice, or guidance on issues involving securities laws, insurance laws nor securities or insurance regulations. This material should not be relied on as providing any such advice or guidance to either agents or retail consumers. Within this communication, AIPMA shares links for usage as information only. This content should not be interpreted as solicitation to purchase life insurance, annuities, or other products or as advice designed to meet your clients’ specific needs. Content involving fiduciary, tax, or legal advice should be directed to your legal, tax, and financial professionals for specific advice or product recommendations. AIPMA will not accept any legal liability resulting from any use of 3rd party material(s).

Latest Posts

Categories

Tags

Final Expense Fixed Indexed Annuity Global Atlantic Women Wink Leads Securian Financial Corebridge Financial Mental Health Aipma Tax Season Disability_Insurance Limra Fidelity Guaranty Life Long_Term_Care Taxes Myaip Iul Equitrust Nationwide Culture Integrity Term Life Insurance Charity Tips Indexed Universal Life Annuity Financial Planning Web Meetings Regulations Holiday Webinars Ipipeline Medicare_Supplements Fixed Annuity North American Retirement Planning Carriers Lincoln Financial Group Permanent Life Insurance Social Media Protective Myga Life_Insurance Foresters Financial RingcentralContact Us

800.783.5206

2041 E. Square Lake Road, Suite 100, Troy, Michigan 48085-3897

About Us

For more than 40 years, AIP Marketing Alliance (AIPMA), an Integrity Company, serves as a premier life insurance and annuity distribution partner to provide full-service support to independent wholesalers, brokerages and agents from our Troy, Michigan office. NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR THE MEDICARE PROGRAM. Copyright 2025