Sales Idea: Help Clients Navigate Market Volatility in Retirement with Permanent Life Insurance

Analysis of “sequence of return risk” shows that withdrawing income early in retirement during a down market can significantly reduce portfolio longevity. Show your clients how a cash value life insurance policy can help protect them from this risk by providing an alternate source of income during down markets.

We want to show you a hypothetical situation below to explain sequence of return risk. This information should not be used to make a financial decision and is provided as education only.

Client Profile

- Male, age 50, Super Preferred NS, married

- All children are “out of the house”

- No mortgage or other significant debt

- Desires approximately $60,000 of annual after-tax income during retirement (not including Social Security benefits)

- Is able to direct $2,500/month to additional savings

Impact of Sequences of Returns

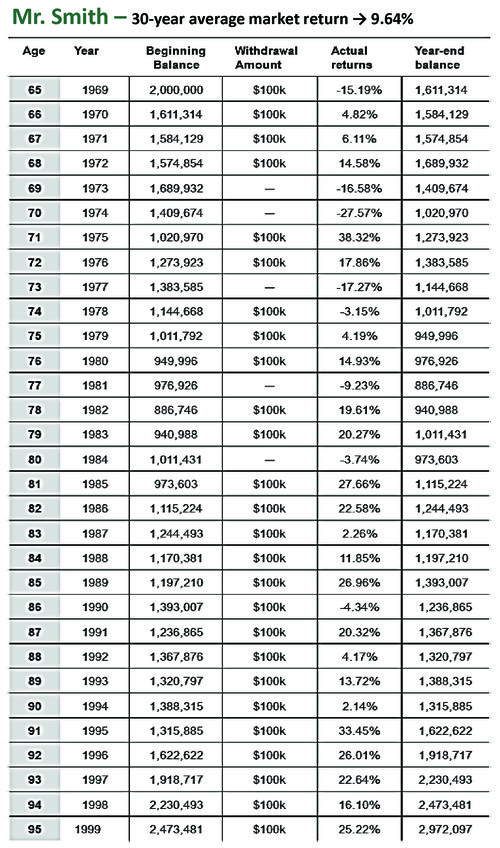

Compare Mr. Smith (retiring in 1969) and Mrs. Jones (retiring in 1971):

- Each start with retirement accounts with $2M

- Each withdraws $100k annually

An Alternative Scenario for Mr. Smith

What if Mr. Smith had been able to avoid taking withdrawals during the years when the market performed negatively (excluding year 1) because he had another tax-advantaged source of income he could access? In that case, he likely would have experienced a much different outcome with respect to the longevity of his account.

Conclusion

Cash value life insurance can help manage the sequence of return risk clients will face during their retirement years. And using an indexed universal life policy can help drive cash value growth at potentially higher crediting rates than a traditional UL policy can, while offering a “floor” that provides downside protection during down markets. What’s more, adding a long-term care rider gives clients additional protection of their primary income assets. In short, cash value life insurance offers a solution that clients may be looking for, now more than ever, to help cover times of financial uncertainty.

Avoiding withdrawals from this account in years when there were negative market returns substantially increases its potential longevity. However, in order to avoid taking taxable withdrawals in this manner, Mr. Smith would likely need another source of income from which to draw. Permanent life insurance can serve as this source of tax-free income.

Although Mr. Smith experienced a slightly higher than average rate of return over a 30-year period, his outcome was much different due to the sequence of those returns. *This is a hypothetical of those returns.

We have a consumer-approved flyer with this sales concept available to insurance professionals. Please contact AIP Marketing Alliance’s Business Development team at (800) 783-5206 Press #2 or marketing@aipma.com.

Disclaimer

Most insurance policies contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. An insurance professional can provide you with costs and complete details. Guarantees are based on the claims-paying ability of the issuing insurance company. AIP Marketing Alliance is not an insurer and does not issue contracts for coverage. This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice.

Latest Posts

Categories

Tags

Iul Taxes Lincoln Financial Group Aipma Permanent Life Insurance Webinars Equitrust Limra Tips Legal And General Regulations Nationwide Leads North American Foresters Financial Disability_Insurance Fixed Indexed Annuity Ira Life_Insurance Nafa Social Media Insurance Fraud Charity Retirement Planning Mental Health Myaip Job Posting Corebridge Financial Integrity Holiday Term Life Insurance Long_Term_Care Culture Indexed Universal Life Myga Final Expense Protective Medicare_Supplements Annuity Carriers Tax Season Web Meetings Regional Director Open Enrollment Secure Act Women Drop Ticket American Equity Wink Fixed Annuity Transamerica Roth Ira Ringcentral Securian Financial Financial Planning Fidelity Guaranty Life Global AtlanticContact Us

800.783.5206

2041 E. Square Lake Road, Suite 100, Troy, Michigan 48085-3897

About Us

For more than 40 years, AIP Marketing Alliance (AIPMA), an Integrity Company, serves as a premier life insurance and annuity distribution partner to provide full-service support to independent wholesalers, brokerages and agents from our Troy, Michigan office. NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR THE MEDICARE PROGRAM. Copyright 2024